Your cart is currently empty!

Don’t Sell the Damn Stock!

Warren Buffet once said that the best investment that Berkshire has ever made was the Headhunter fee paid for hiring Ajit Jain in 1986.

On September 9th 2024, Ajit sold 200 shares of Class A stock – more than half of his shares.

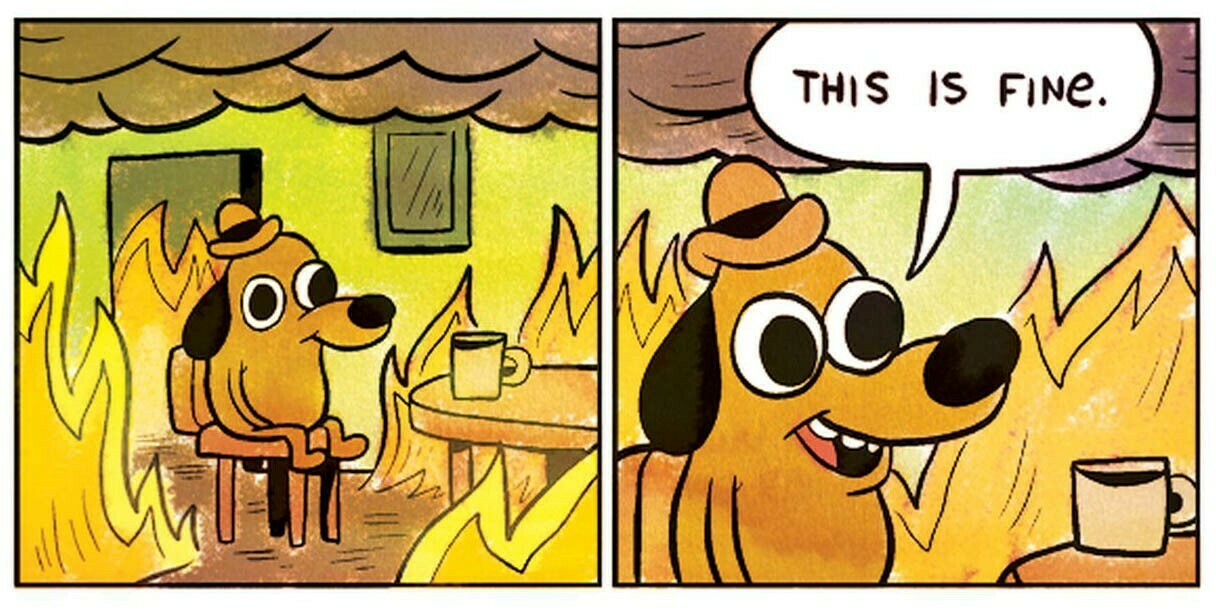

What is going on here??

I have no idea what his motivations might be.

Buffett has sold half of Berkshire’s Apple shares, he is reducing Bank of America at a steady pace and now Ajit dumps more than half of his own Berkshire shares.

What is going on here??

Do these guys see something in the economy that everyone else is missing? Are they worried about potentially paying tax on unrealized gains? Can they be raising money to buy a Super Yacht, travel around the world and live it up like a couple of Russian oligarchs in retirement? Or are these companies simply fully valued as David Kass suggests in this CNBC report?

I don’t have a clue what the answer is.

I DO know that as a Berkshire shareholder I am going to take the advice that Charlie Munger gave his own family for after his and Buffett’s death.

That advice?

“Don’t sell the damn stock!”

Posted

in

by

Tags: