Speculation is rampant regarding Warren Buffett’s recent moves. He has continued selling off large portions of Berkshire Hathaway’s Apple holdings, refrained from buying back shares this past quarter, and accumulated a cash reserve now representing about a third of the conglomerate’s overall value.

Analysts and investors are buzzing with theories about Buffett’s motivations, which could include:

- Expecting a Recession: Some believe Buffett is preparing for a downturn by boosting Berkshire’s liquidity.

- Positioning Pre and Post Election: Others speculate he may be selling ahead of potential election-related market volatility.

- Tax Strategy: It’s possible these sales are driven by tax considerations, especially with discussions of changing capital gains taxes.

- Succession Preparation: Another theory is that he’s streamlining the portfolio for his successor.

- A Large Acquisition in Sight: Finally, some suspect that Berkshire is eyeing a substantial investment opportunity.

Despite all the speculation, only Buffett truly knows his plans. In August I floated the idea that Buffett is preparing a Dividend, but I think it would be folly to think anyone truly knows what is really going on.

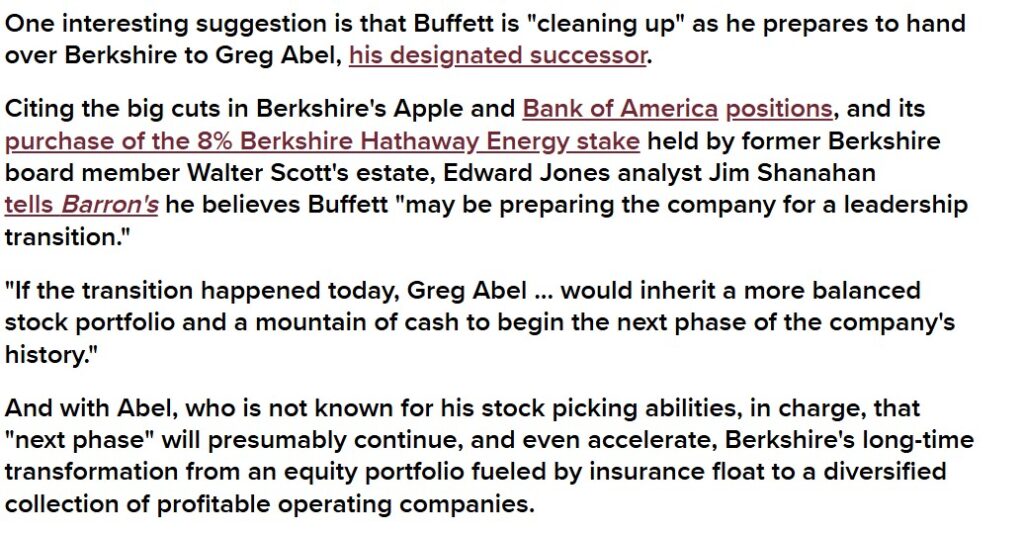

I did read this post on Buffett on CNBC’s Buffett Watch that made me think. This is a great newsletter that goes out weekly written by Alex Crippen. Alex describes this interview with Analyst Jim Shanahan:

The last paragraph is what caught my eye. I believe Buffett is indeed thinking about how he’ll leave the “ship” for his successor, Greg Abel. However, I don’t expect the core strategy to change under Abel’s leadership. Berkshire has long prioritized full acquisitions, and I anticipate a continuation of that philosophy along with Berkshire’s practice of making significant, non-controlling equity investments.

At the last Shareholder meeting, Buffett clarified that Abel will be responsible for capital allocation going forward. Buffett has always emphasized the mindset of stock ownership as business ownership. If Abel adopts that philosophy, as I presume he does, there should be little difference between Berkshire’s strategy of acquiring companies outright and investing in significant equity stakes in businesses.