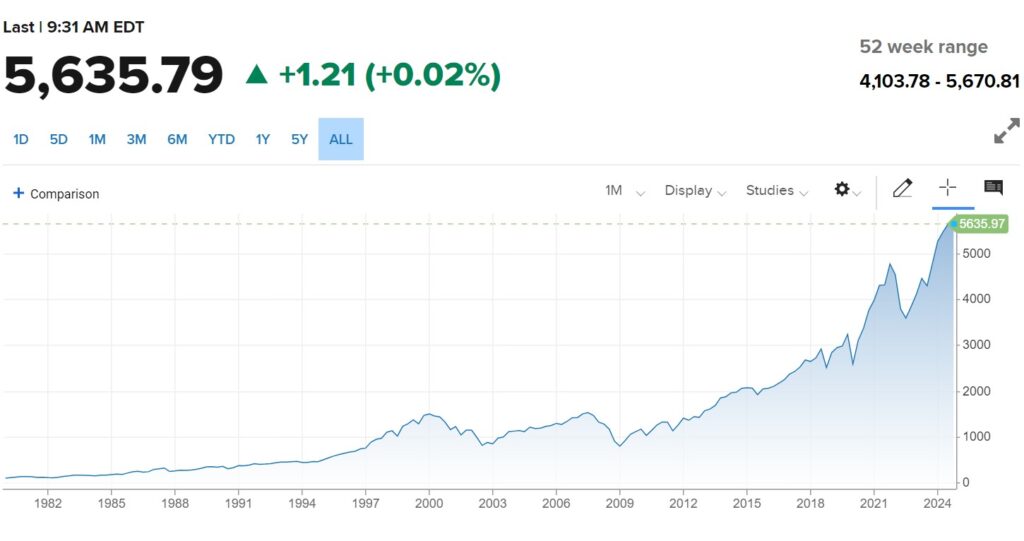

On March 16 2022, with inflation seeming to be no longer transitory, the Fed began a season of increasing interest rates. They turned on the lights and the party that lasted from 2008-2022 was over. That day in March, the S&P 500 closed at 4,357.86.

The Fed went on to raise 525 basis points (5.25%) up through July 2023.

Some things broke 👀Silicon Valley Bank and people took to the airwaves almost daily screaming about the impending recession and market crash.

Today the Fed will begin to cut rates and begin a new season. Yesterday, the S&P 500 closed at 5,634.58. Party on!

My big take away is simply to ignore the noise and continue to bet on America – our companies and our innovators.

This chart of the S&P 500 is from 1980-present. During this time, basically my lifetime, a lot of terrible things happened. We had wars, terrorist attacks, financial crises, 80’s style clothes and countless other problems. Just look at how far we have come!

During this time the internet proliferated the planet, we sent rovers to Mars and now walk around with super computers and the worlds knowledge in our pocket!

I remember a teacher telling us in school that we had to learn the math because we would not have calculators in our pockets! A lesson right there to not try and predict the future.

With that, It’s impossible to know what the Fed will do from here but I am confident that American innovation and America’s top 500 companies will continue to thrive in the long run.

Party on!